Identity Verification &

Fraud Prevention Platform

TrueCheck

Powered with Fraud Prevention Framework, enabled Unlimited usage, Fixed cost, Offline Enterprise Solution which simplify and secure Identity and Financial Transaction.

Employ advanced technologies like AI-driven Tamper detection, Fraud Prevention and Object AI between documents and process to enhance security measures and thwart unauthorized access attempts.

Features

Explore the Unique Features Designed to Enhance Your Experience and Drive Results

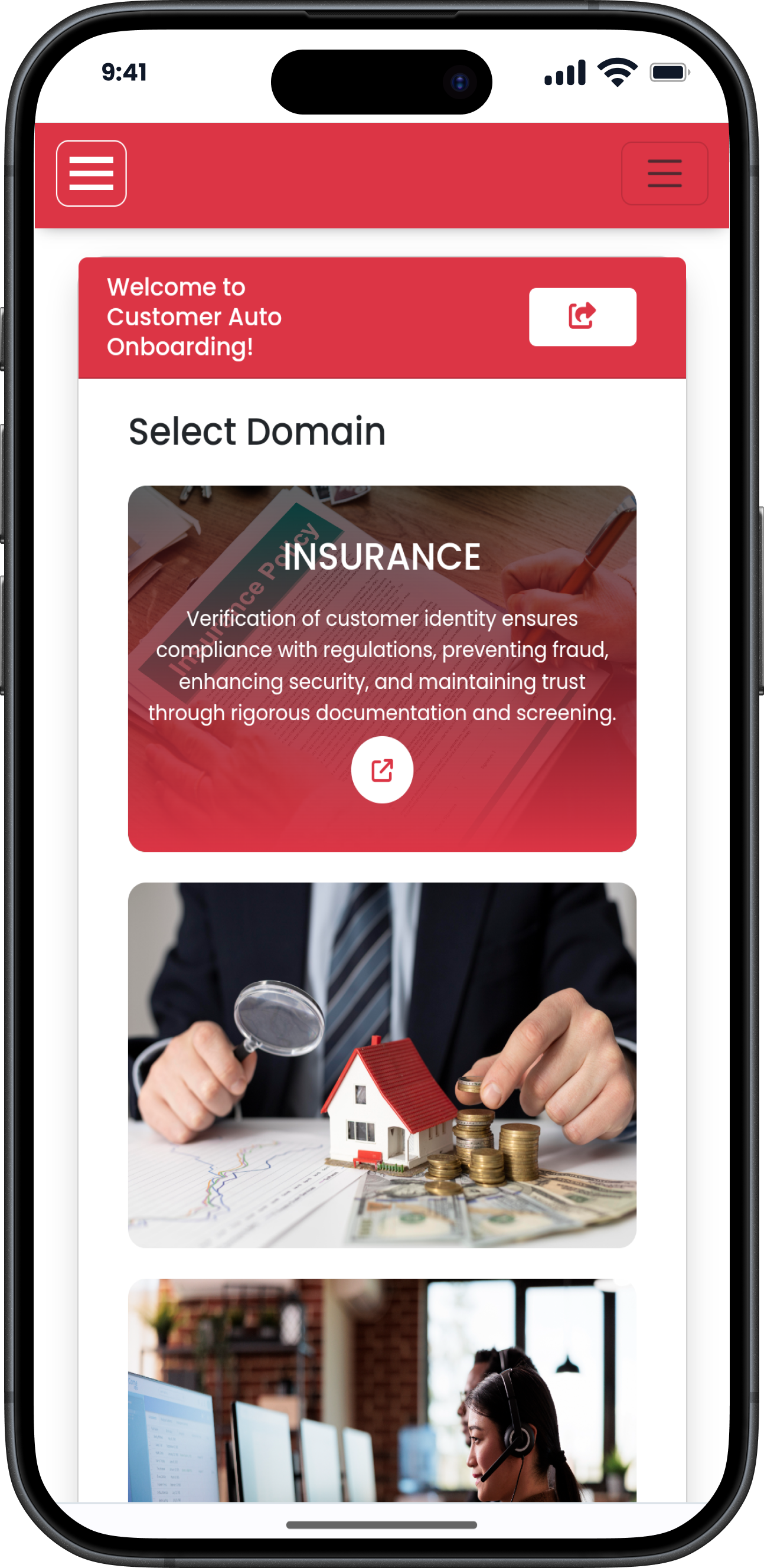

Automated Onboarding

Tamper Proof, File identification and classification up to 50+ Templates, Auto Form Filling (OCR, Face, Sign). 4X fast solution.

200+ Million, Successful Contactless Onboarding.

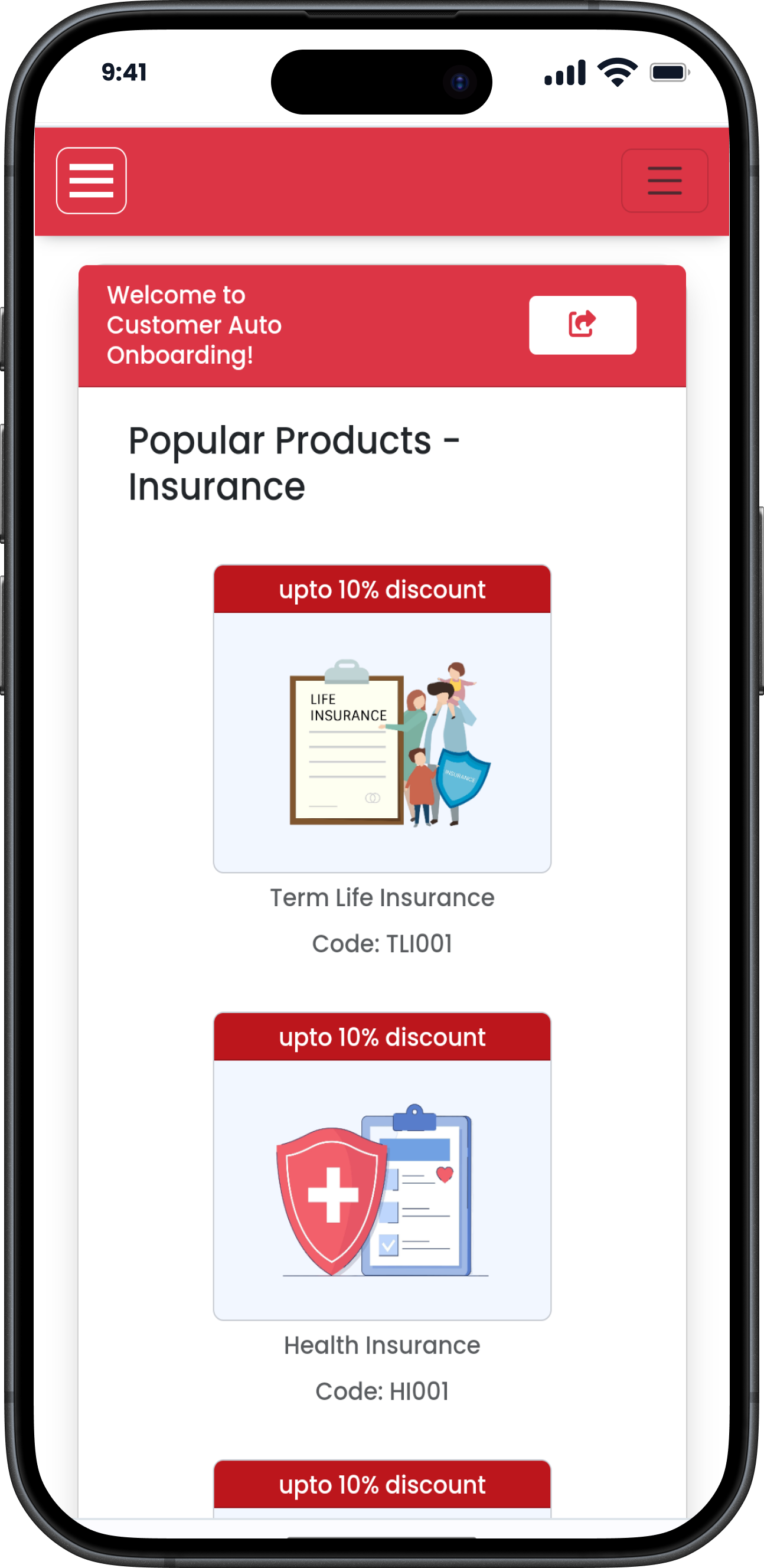

Automated Underwriting

File identification and classification up to 30+ Template, Automated Underwriting on KYC document as per BRE Rule & requirements.

700+ Million, Successfull Underwriting.

Medical Underwriting

Medical Underwriting Automation Medical Report and Bills extraction and verification, tracking micro data (line items, row, columns), BMI calculator and much more.

Financial Underwriting

Financial Underwriting Automation Automate risk assessment with FRA (Financial Risk Assessment), tracking micro data (line items, row, columns, pattern, format, spellings), cross document verification, data-driven and rule engine (137+ FCPS Rules) based decision-making.

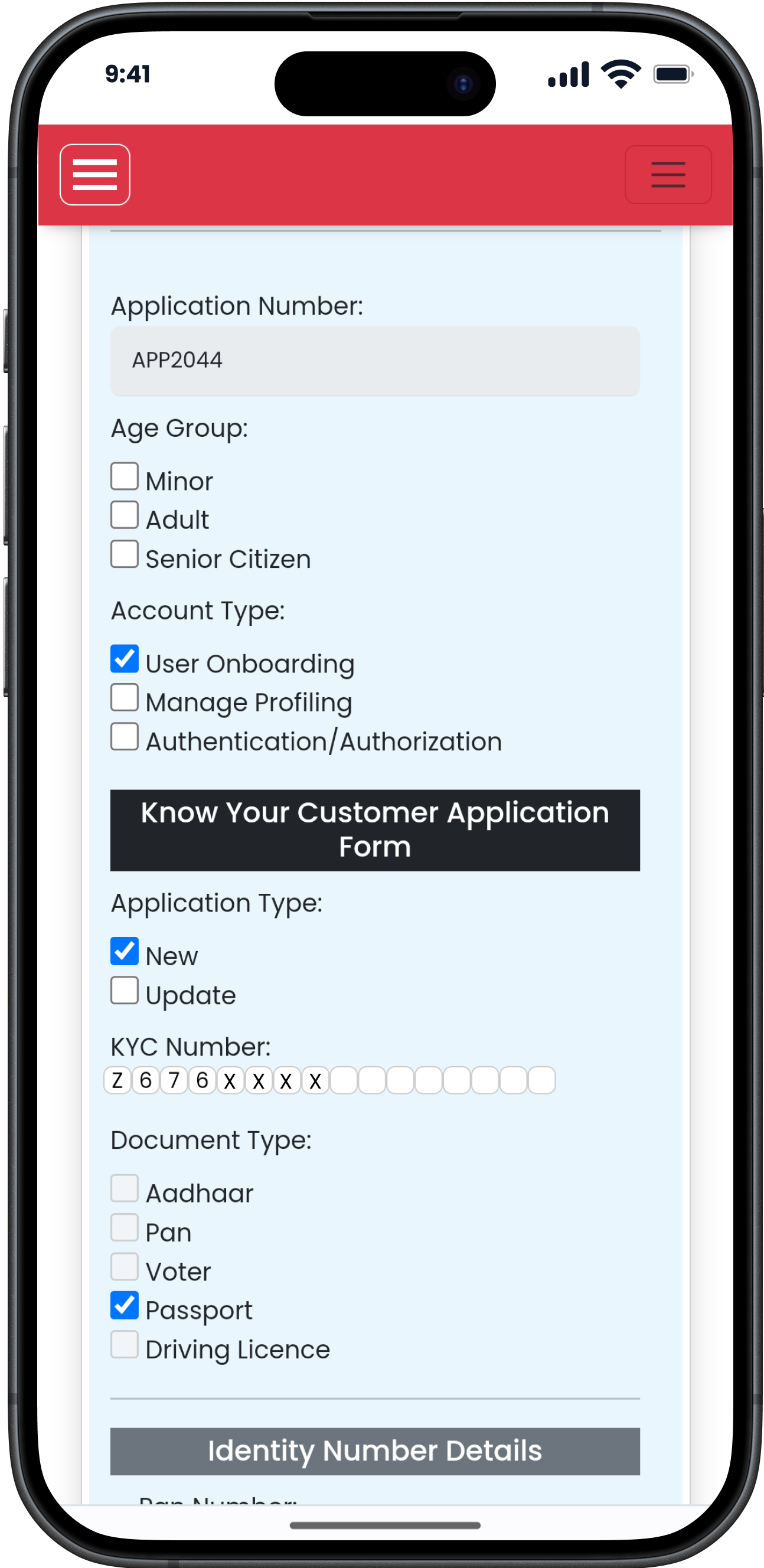

Profiling (Verification)

Spam Protection, Liveliness check and customer verification via VKYC, OKYC, and Pan360 Dedupe, provide Demographic details and visual identity, Pre-filled Identity Verification/ Consent.

Fraud Prevention

Inbuilt spam protection, offline-online fraud prevention, and deduplication involves implementing measures and strategies to detect, deter, and mitigate fraudulent activities or tampering.

Financial Risk Management

File identification and classification up to 20+ Template, Automated Underwriting on Financial documents as per 130+ x-Biz Rules.

2+ Billion $, Saved for our clients.

Compliance & Dedupe

Maximize network efficiency with minimal risk and fraud using large scale dedupe entity. Inbuilt Masking (Aadhaar , Pan), Risk Profiling.

USP Features

Following are the other USP Features

Banking

Embrace AI to streamline operations, enhance security, and drive innovative banking solutions.

Learn moreInsurance

Leverage AI to reshape risk assessment, claims processing, and delivering tailored policy recommendations.

Learn moreServices

Following are the Digi APIsetu Paperless Services

KYC Verification

KYC verification is the process of verifying the identity of a customer to prevent fraud, money laundering, and financial crimes.

Banking Verification

Banking verification is essential for confirming the authenticity of an account holder's identity. This process helps prevent fraud and ensures the security of financial transactions.

GST Verification

GST verification is crucial for validating a business's GST registration status and compliance. This process helps ensure that the business is properly registered and adheres to tax regulations.

Employee Verification

Employee verification is crucial for validating the identity and credentials of employees. This process helps ensure the accuracy of employment records and prevents identity fraud.

Healthcare Verification

Employee verification is crucial for validating the identity and credentials of employees. This process helps ensure the accuracy of employment records and prevents identity fraud.

CIN/DIN Verification

Employee verification is crucial for validating the identity and credentials of employees. This process helps ensure the accuracy of employment records and prevents identity fraud.

Location Verification

Employee verification is crucial for validating the identity and credentials of employees. This process helps ensure the accuracy of employment records and prevents identity fraud.

Social Networking

Employee verification is crucial for validating the identity and credentials of employees. This process helps ensure the accuracy of employment records and prevents identity fraud.

Trusted by Leading Global & Indian Customers

Explore the Expanding Range of Platforms Dedicated to Verifying Online Identities and Preventing Fraud

200 Million

Online Identity Verification

2.7 Billion

Financial Protection

370 Million

Online Onboarding

2.7 Million

Financial Fraud Prevention

Have a question? Check out the FAQ

We believe brand interaction is key in communication. Real innovations and a positive customer experience are the heart of successful communication.

What is TrueCheck automated onboarding?

TrueCheck Automated onboarding refers to the use of technology to streamline the process of enrolling new customers or users, reducing manual intervention, and speeding up the verification and approval process by 7X.

How does identity verification work in the TrueCheck platform?

Spam Protection & Deduplication with Customer Data!

Paperless

TrueCheck platform uses AI and machine learning to validate government api data, match Facial recognition, validate digital Signature for Automated Onboarding,

Paperbase

TrueCheck platform uses AI and machine learning to prefilled & validate scanned Documents, match Signature & Facial recognition for Automated Onboarding,

After Automated or Manual Onboarding, it does cross-check (Automated Underwriting) user information against internal and external databases (Deduplication) to ensure the authenticity of the unique and trusted identity for customer Profiling.

What types of documents can be verified?

The platform typically supports the verification of various Paperless - Goverment Services & paperbased documents such as:

KYC (Passport, Driving License, Pan Card, Voter Card & Aadhaar Card)

Financial (Bank Statement, Cheque, ITR, Form16, Form26AS, NACH, PaySlip & PNL)

Medical (Test Reports, Hospital RateCard & Medicine Bills)

Utility, Mobile, Electricity, Invoice bills and more.

How does the TrueCheck platform ensure compliance with regulations?

The platform is designed to comply with global and local regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering), ensuring that businesses meet all legal requirements.

It also complies with other Indian authorities, such as IRDA, RBI, SEBI, and TRAI.

Is the identity verification process secure?

Yes, the platform employs encryption, secure data storage, and other security measures to protect sensitive information during the verification process.

How long does the onboarding and verification process take?

The onboarding and verification process is typically completed within a minute or two, depending on the complexity of the product and services offered or the provided customer documents required by the usecase.

What happens if a document fails verification?

If a document fails verification, the platform may prompt the user to provide additional information or documents against the trigger requirement via "Business Rules Engine" (BRE) or it may flag the account for manual review (Manual Underwriting).

KYC typically System has 97% Field Level and 92% Document level STP using Automated Underwriting.

Financial typically System has 94% Field Level and 90% Document level STP using Automated Underwriting.

Medical typically System has 98% Field Level and 95% Document level STP using Automated Underwriting.

Can the platform detect fraudulent activities?

Yes, advanced fraud detection features are integrated, using AI to identify suspicious patterns and flag potential fraud attempts.

Offline Tamper Detection using CFA, Data Pattern Validation, Face and Signature Verification!

Online BlockChain, Internal Deduplication, External Deduplication (Government Services - API, Social Profiling and Scanning)!

Can the platform be integrated with existing systems?

Most platforms offer API integrations, allowing seamless connection with CRM systems, financial services, popular DMS and other business applications.