Automated Underwriting (eyeball KYC-UW elimination)

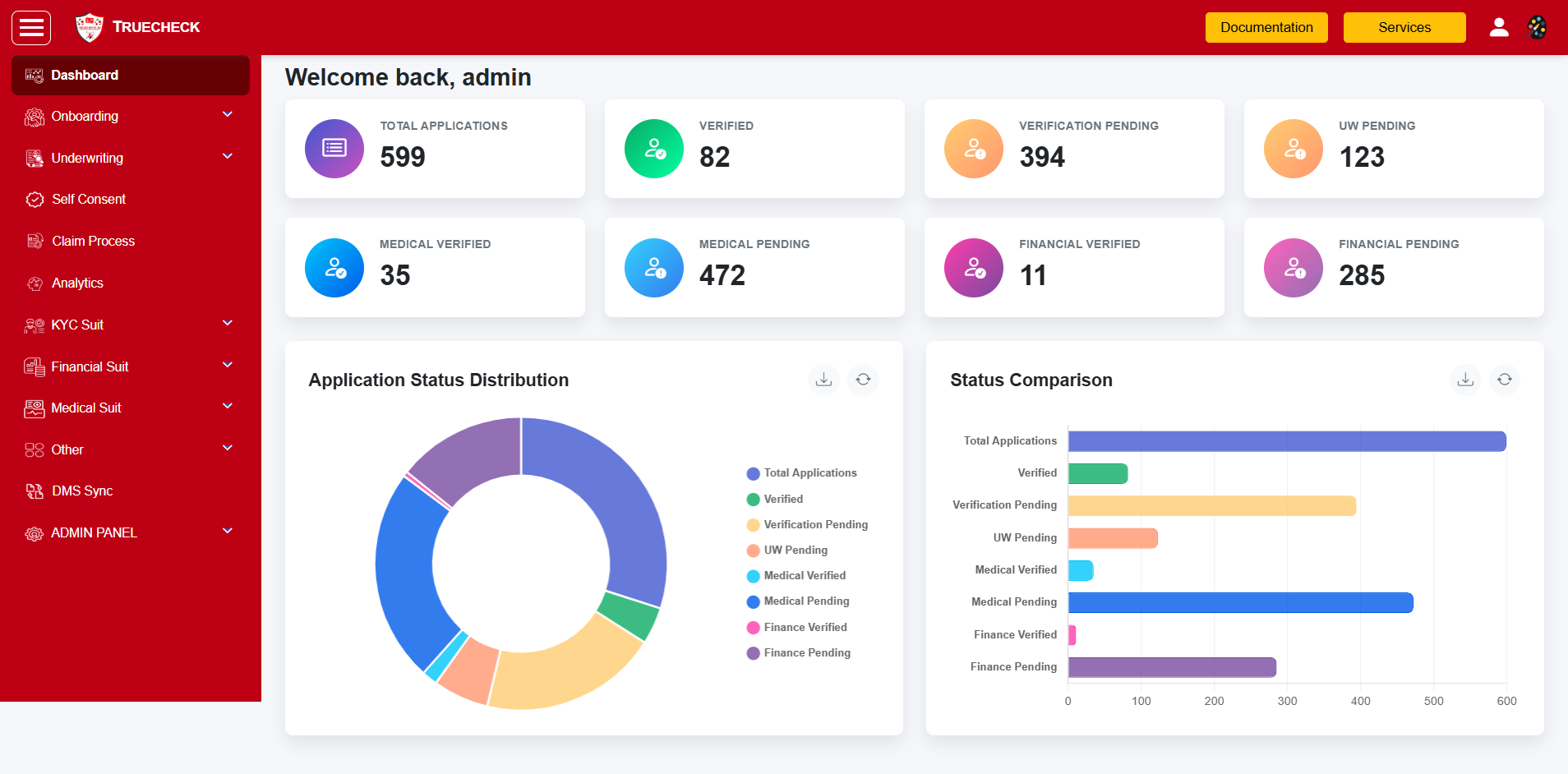

Basis of BRE rule, AI-driven automation in Underwriting brings complete risk visibility into a case. It thus helps in suggesting the best possible decision to the UW system with no time.

Automated Underwriting (KYC Verification) uses AI automation and BRE rules to swiftly assess risk, aiding efficient decision-making and streamlined KYC verification.

ITR 1-6, CPC, Form16 A-B, Payslip, Bank Statement summarizes your financials for a given year/month, page by page. Analysis and overview of income, loss, expenditure, tax, credits, debits, charges, and settlements by listing details are complicated and time consuming.