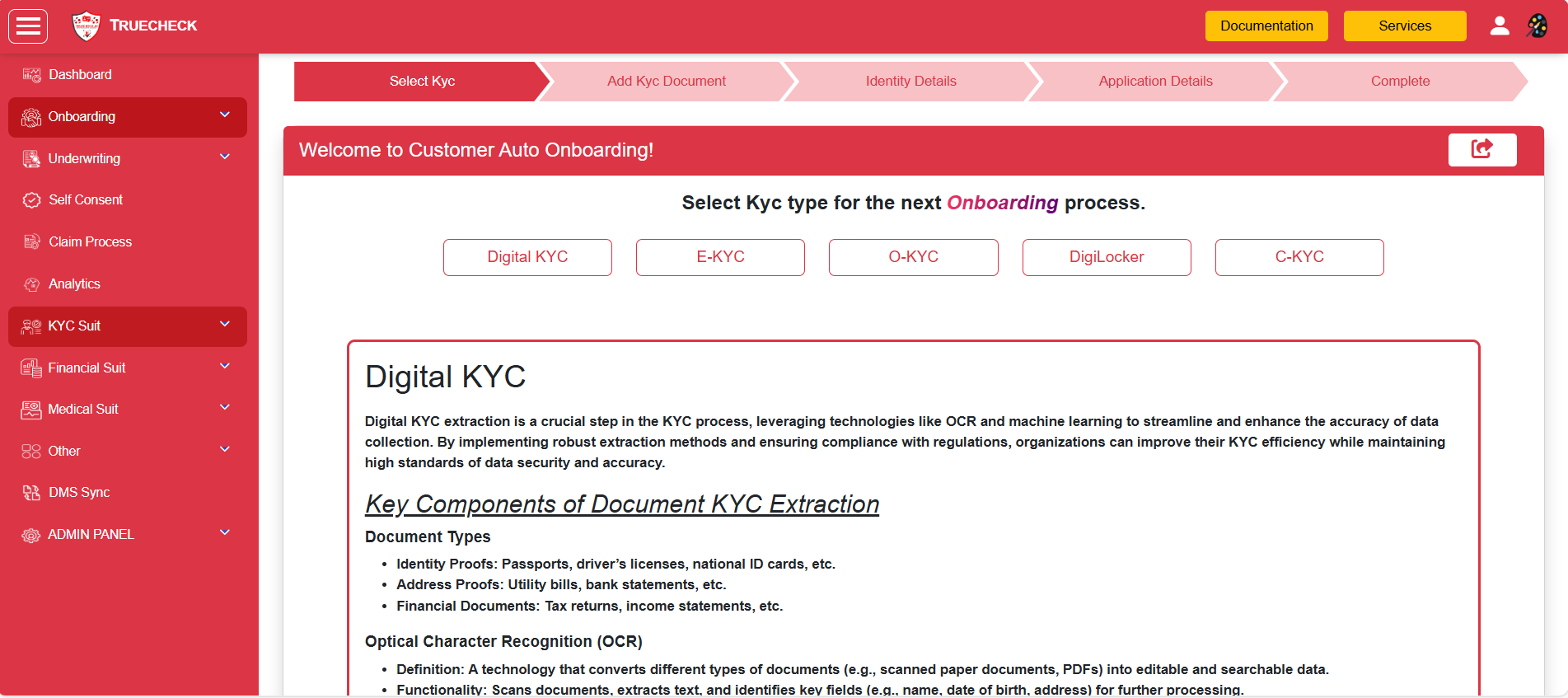

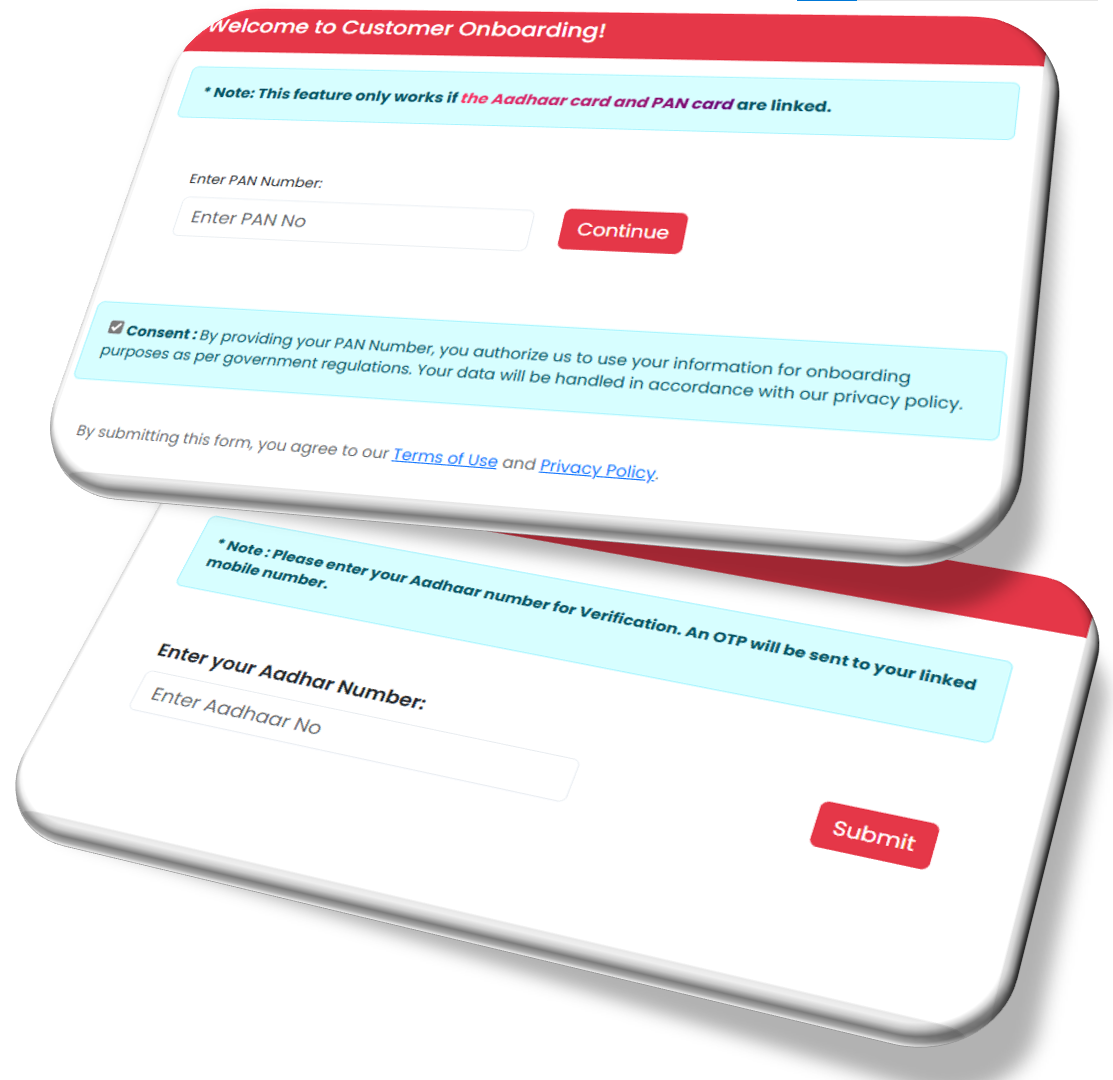

KYC Verification & Automated Onboarding

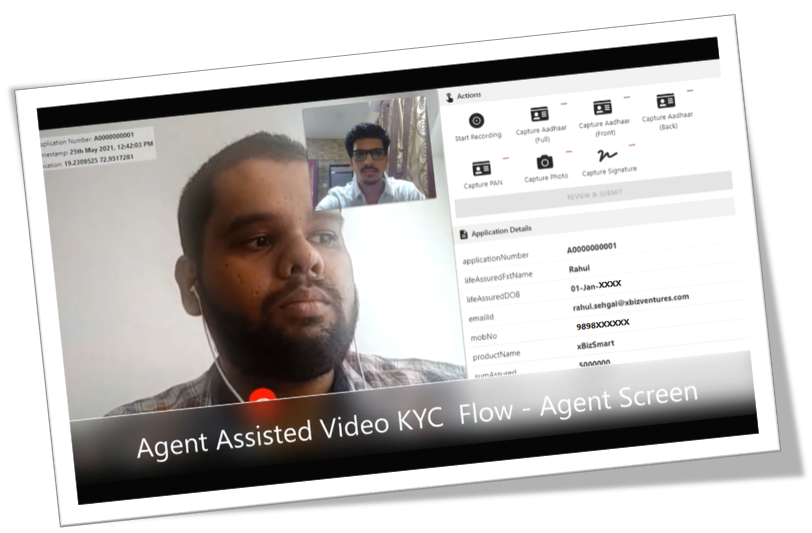

A Document KYC would involve the collection and verification of specific documents to confirm the identity and other relevant information about a customer.

Enhance the onboarding experience for insurance customer by streaming data collection and verification processes, ensuring a seamless and efficient enrollment journey.