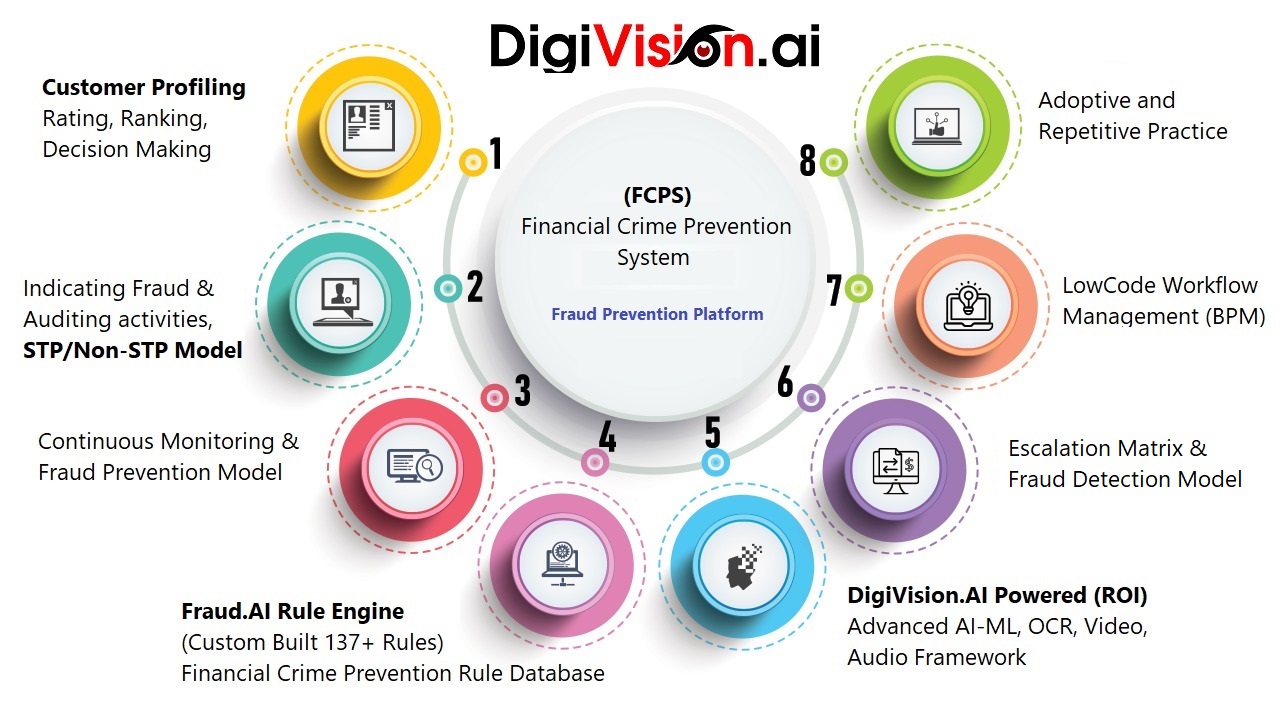

TrueCheck.AI platform offers comprehensive identity verification and fraud prevention solutions, utilizing advanced technologies like OCR (Optical Character Recognition), Face-Sign Match, Video KYC and E-KYC (Know Your Customer).

OCR extracts and digitizes text from images, while Face-Sign Match compares facial features with signatures for verification. Video KYC ensures secure, real-time identity verification through video interactions.

Auto-underwriting and auto-onboarding automate decision-making in customer onboarding, reducing manual intervention. Dedupe-based identity verification detects and eliminates duplicate records, enhancing data accuracy.

It utilizes AI-driven technologies to authenticate identities quickly and accurately, reducing the risk of fraud. The platform integrates seamlessly with financial systems to provide real-time fraud prevention, leveraging data analytics and machine learning to detect and prevent fraudulent activities.